From Soft Law to Hard Law: Fundamental Changes in Expectations For ESG Integration Among Asset Managers And Investment Advisors

As described in the previous blog, the European Commission has presented an action plan for financing sustainable growth (read it here). We go a step further in this blog by zooming in on concrete proposals from the action plan and examples of the consequences this can have for capital market players.

By Lotte Mollerup, Managing Partner & Sebastian Olguin Sørensen, Consultant | The 5th of July 2019

The European Commission has with significant pace been able to put the financial sector’s sustainable transition at the center of attention. Since the launch of the action plan 15 months ago, agreements have been reached on new low-emission benchmarks and disclosure requirements, and there has been established a Technical Expert Group (TEG), which among other things, has made the first draft definition of a taxonomy for certain environmentally sustainable activities.

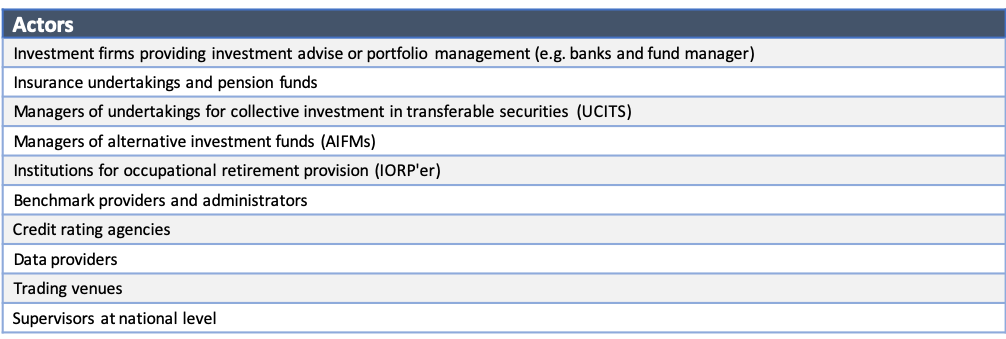

In order to gain an overview of the scope of the upcoming regulation, it is worth noting the actors that will be affected by the action plan. If one collects the preliminary draft amendments and the action plans, the financial sector is affected over a wide range. Reference is made, inter alia, to:

Financial products will also be affected by the legislative measures put forward, to the greatest extent for products offered as exclusively sustainable.

In order to illustrate examples of the expected requirements that the action plan entails, this blog will look more closely at action 4 – Incorporating sustainability when providing investment advice.

Example of expected requirements: Incorporating sustainability when providing investment advice

In early 2019, the Commission submitted an update to MiFID II in the form of a draft delegated act. It intends to clarify how sustainability risks and ESG considerations can be integrated with the investment advice.

The new changes will require customers to be asked about their ESG preferences, after which investment companies and insurance distributors take these into account as part of the product selection process and suitability assessment. However, it is emphasized that investment objectives, time horizon and risk profile are still to be assessed first, after which ESG preferences can be included.

To assess the best way to incorporate ESG preferences in investment advice, the Commission has requested technical advice from the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA). ESMA and EIOPA delivered their final reports by end April 2019.

In general, the two supervisory authorities have provided input in five areas. These are outlined below:

Figure 1: Areas under existing legislation where ESG is expected to be incorporated, cf. Action 4

The proposals coincide to a certain extent across the various legal areas, in an attempt to streamline ESG across the sector.

Generally, this means that the following business areas will be affected by the changes:

- Organizational & procedural processes, among other things governance and identification of target market

- Training of board and staff

- Risk management & compliance

- IT/ESG-data

This implies that ESG considerations to a much greater extent must be integrated into processes, systems and controls and thus be anchored in the organization. This applies from the involvement of the board of directors and senior management in strategy and direction, to handling processes, for example in the form of portfolio surveillance, where ESG risks will be expected to be identified and monitored, for both individual investments and at portfolio level.

Product Governance

One of the more debated subjects has been product governance, where ESMA has proposed the inclusion of ESG preferences in the target market assessment for financial products. In practice, this will mean that it is no longer enough to specify that an investment product has customers interested in ESG/sustainable investment as the target market; instead, it must be clarified which ESG preferences an investment product meets. This will as a minimum imply a target market based on E, S and G. respectively.

It is worth noting that the product manufacturer as well as the distributor will be required to take ESG preferences into account.

The proposed approach is expected to result in two main types of target market:

- ESG-positive products

- Non-ESG products

As far as suitability is concerned, financial institutions subject to MiFID II are already encouraged to include customers’ ESG preferences today, but in the future, this will go from “good practice” to actual requirements. ESMA is expected to publish guidelines on the topic during the second half of 2019.

Figure 2: ESG considerations will in the future be included for target market as well as suitability

Focus areas and challenges going forward

The task of complying with the expected ESG requirements is considered to be greater than first assumed if assessing comments and discussions by ESMA and EIOPA consultations. To a large extent this is due to the lack of maturity of the ESG market, for example concerning data and standards that pose major challenges:

Data

Despite the great interest in sustainability, there are still major challenges, particularly in terms of data availability and quality. One must assume that the new ESG requirements will not necessarily create the need for new IT systems, nonetheless new adaptations of current IT-supported processes for data flow will be needed, which today typically cross many players and roles.

Standards

In connection with the data questions, there are still major issues regarding standards. As an example, reference is made to using the taxonomy when specifying the ESG preferences that an investment product meets. This imposes challenges given that such a taxonomy still is not available in full format. Until this is finalized, reference is made to current market standards and the preparatory work published by the Commission. However, market standards are generally developed for the national sectors, which makes comparison across Europe difficult today.

Sequence of legislative adoption

The last but not insignificant area to notice is the sequence of legislative adoption. Action Point 1 – The Taxonomy – is the overall focal point for most of the Action Plan. Given that this is vastly complex and technical to develop, the EU side has started gradually by first focusing on sub-elements of the environmental activities. This of course presents challenges when the taxonomy is the foundation for many of the remaining action points, which are presumed to come into force before a complete taxonomy is adopted.

Next Blog

We will continue our series on the EU Action Plan and its implication for capital markets participants. Our next blog will shed light on disclosure requirements, and the expected consequences this will have from a strategy perspective to governance, policies and risk management.

How can CMP help your business?

If you have any questions about the EU Action Plan or ESG areas, please contact us for more information on how we can help your business further.

Lotte Mollerup, Managing Partner

Lotte Mollerup has been working in the financial sector since 1988. Throughout the years, Lotte has worked as an Executive Director at Finans Danmark, Head of Department at Realkreditrådet, Executive Director at PenSam, Chief Consultant at the Danish Ministry of Industry, Business and Financial Affairs, Attaché for Financial Affairs at the Danish EU representation in Brussels, and Assistant Vice President at The Central Bank of Denmark.

Lotte is an expert within the field of financial regulation, capital market affairs, corporate governance, compliance and risk management.

Sebastian Olguin Sørensen, Consultant

Sebastian Andre Olguin Sørensen is a consultant and works closely with CMP’s experienced consultants, when solving assignments in a broad range of finance related activities. As his primary focus, Sebastian has great competencies in the field between investment management and responsible investment, with particular focus on institutional investors from the Nordics and their environmental, social and governance (ESG) integration.

Read more about Lotte, Sebastian and our other consultants here

Sources:

http://europa.eu/rapid/press-release_IP-19-1418_en.htm

http://europa.eu/rapid/press-release_IP-19-1571_en.htm

https://ec.europa.eu/info/publications/sustainable-finance-technical-expert-group_en