EU’s Action Plan For Financing Sustainable Growth Entails New Regulation for Financial Institutions

Responsible Investment and sustainable growth are amongst the hottest topics in the financial world. The European Commission has placed itself in front of this agenda with the launch of their ‘Action Plan for Financing Sustainable Growth’. The first EU regulation is already adopted, yet financial market participants are only at the beginning of this regulatory movement with sustainability as the focal point. Follow the first blog about the importance of ESG and sustainability in the capital market.

By Lotte Mollerup, Managing Partner & Sebastian Olguin Sørensen, Consultant | The 2nd of July 2019

Background

The communication from the Commission is clear: the long-term competitiveness of the EU depends on sustainability and the transition to a low-carbon, more resource-efficient and circular economy. In several areas, the EU has already committed itself to contributing to this effort.

In November 2018, the European Commission adopted a long-term strategic vision for a climate-neutral economy by the end of 2050. This initiative, among others, is in line with broad international agreements such as the Paris Agreement and UN’s 17 Global Sustainable Development Goals.

However, the Commission estimates that further investments of between € 175-290 billion a year are still lacking in Europe, in order to achieve the goal of becoming climate neutral by 2050. To close this gap, ESG integration and sustainable investment have become the focal point of the financial sector.

The EU Action Plan

On the 8th of March 2018, the European Commission presented their 10-point action plan, that aims to identify the obligations of institutional investors and asset managers, and to include the financial sector in the sustainable transformation to a larger extent. The action plan is developed on the basis of recommendations from a High-Level Expert Group, following the desire to set up a European Capital Markets Union (CMU) and the adoption of the Paris Agreement and the UN’s 17 Global Sustainable Development Goals.

In short, the action plan has three main objectives:

- Reorienting capital flows towards a more sustainable economy;

- Mainstreaming sustainability in risk management; and

- Fostering transparency and long-termism.

1. Reorienting capital flows towards a more sustainable economy

The EU has committed itself to supporting an environmentally and socially sustainable economic system, including: through concrete climate and energy targets, and by allocating at least 20% of its budget to climate-relevant areas. Nonetheless, it is clear that the current level of investments is not enough to support such a sustainable economy – in other words, there are not enough capital flows that go in the direction towards a sustainable economy. This is due, among other things, to the lack of clarity among investors and private customers in relation to standards and concepts. The EU lacks a common definition – or taxonomy, if one wishes – of sustainability, which helps prevents sustainable financing.

2. Mainstreaming sustainability in risk management

Financial market participants today no not necessarily take due account of environmental and climate risks. The EU refers to the destabilizing consequences of environmental and social risks on the EU economy and financial system. Among other things, the EU refers to the fact that up to 50% of the risk exposure of euro area banks is directly or indirectly linked to climate change risks. To bolster the business models adequately to address environmental issues, the EU will encourage financial market participants to integrate sustainability into risk management.

3. Fostering transparency and long-termism

The EU describes a financial system that historically has faced challenges with incentives, general market pressure and corporate cultures that have caused a disproportionate focus on short-term performance in financial and economic decision-making. To address this, the Commission is planning greater emphasis on transparency of market participants’ activities, which applies to both the investor and the issuers (e.g. in the case of business reporting). The EU therefore wants to reduce the pressure to create short-term performance by increasing the incentive for long-termism.

The 10 points of the Action Plan

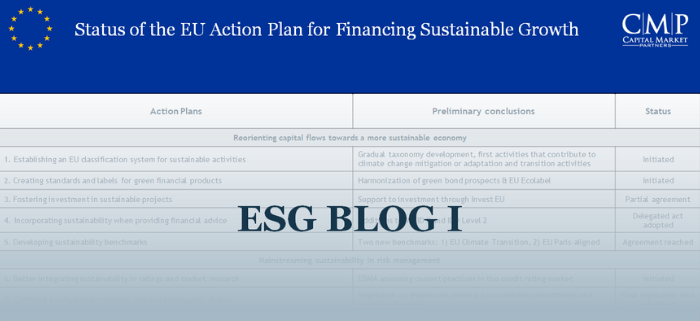

Based on these three main areas, the European Commission has with somewhat near historic speed developed 10 concrete actions points to support the transition. The 10 action points, which were presented back in March 2018, are listed below:

- Establishing an EU classification system for sustainable activities

- Creating standards and labels for green financial products

- Fostering investment in sustainable projects

- Incorporating sustainability when providing financial advice

- Developing sustainability benchmarks

- Better integrating sustainability in ratings and market research

- Clarifying institutional investors’ and asset managers’ duties

- Incorporating sustainability in prudential requirements

- Strengthening sustainability disclosure and accounting rule-making

- Fostering sustainable corporate governance and attenuating short-termism in capital markets.

The majority of these action points are already initiated with respective work processes – below we briefly outline the preliminary conclusion at work:

The Commission’s first legislative proposals

Already in May 2018, the Commission followed up on the Action Plan, by presenting a number of legislative measures based on the action points. The proposals concern

- A proposal for a regulation on the establishment of a framework to facilitate sustainable investment (taxonomy – action point 1).

There is still no agreement on the taxonomy area, despite being at the heart of the action plan. The development of this is highly complex and technical, why the EU has started gradually by first focusing on sub-elements of environmental activities. Specifically, the first draft of the taxonomy will include activities that can make a substantial contribution to climate change mitigation or adaptation, and those that help transition to a net-zero economy by 2050. A report on this was presented in late June 2019, by a Technical Expert Group (TEG) set up by the Commission for the purpose.

The TEG will receive feedback on the report up until September 2019, after which it can be finally drafted, and the Commission may submit it in the form of delegated acts. Subsequently, the taxonomy will gradually be expanded to include other environmental and social aspects.

- A proposal for a regulation amending Regulation (EU) 2016/1011 on low carbon benchmarks and positive carbon impact benchmarks (action point 5).

The European Parliament and the Council have reached agreement on proposals for benchmarks. The agreement creates two new types of financial benchmarks: 1) EU climate transition benchmarks, which aim to lower the carbon footprint of a standard investment portfolio, and 2) EU Paris-aligned benchmarks, that bring investment portfolios into line with the Paris Agreement objectives. Work is currently underway on the criteria for selecting companies that may be covered by the new benchmarks.

- A proposal for a regulation on disclosures relating to sustainable investments and sustainability risks and amending Directive (EU)2016/2341 (action point 7).

The European Parliament and the Council have reached agreement on proposals for disclosure requirements for the integration of ESG factors in investment decisions. This aims to limit the possibility of “greenwashing”, i.e. the risk that products and services which are marketed as sustainable or climate friendly in reality do not meet the sustainability/climate objectives claimed to be pursued.

- Furthermore, the Commission initiated a consultation process on amendments to delegated acts under MiFID II and the Insurance Distribution Directive (IDD), to assess how to best include ESG considerations in the advice provided by investment firms and insurance distributors to individual clients (action point 4).

The Commission intends to clarify how sustainability risks and ESG-considerations can be integrated in the areas of organisational requirements, operating conditions, risk management, product governance (target market assessment and suitability). This will be done either by amending existing delegated acts under the UCITS Directive 2009/65/EC, the AIFM Directive 2011/61/EU, the MiFID II Directive 2014/65/EU, the Solvency II Directive 2009/138/EC and the IDD Directive 2016/97, or by adopting new delegated acts under the same Directives. Accordingly by end of April 2019, ESMA and EIOPA delivered their technical recommendations on the matter.

Next blog

In the next blog we will go into depth with the most relevant initiatives for capital market players, comment on the further process, and what the operational consequences may be for the financial market as well as its participants.

If you have any questions about the EU Action Plan or ESG areas, please contact us for more information on how we can help your business further.

Lotte Mollerup, Managing Partner

Lotte Mollerup has been working in the financial sector since 1988. Throughout the years, Lotte has worked as an Executive Director at Finans Danmark, Head of Department at Realkreditrådet, Executive Director at PenSam, Chief Consultant at the Danish Ministry of Industry, Business and Financial Affairs, Attaché for Financial Affairs at the Danish EU representation in Brussels, and Assistant Vice President at The Central Bank of Denmark.

Lotte is an expert within the field of financial regulation, capital market affairs, corporate governance, compliance and risk management.

Sebastian Olguin Sørensen, Consultant

Sebastian Andre Olguin Sørensen is a consultant and works closely with CMP’s experienced consultants, when solving assignments in a broad range of finance related activities. As his primary focus, Sebastian has great competencies in the field between investment management and responsible investment, with particular focus on institutional investors from the Nordics and their environmental, social and governance (ESG) integration.

Read more about Lotte, Sebastian and our other consultants here

Sources:

https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance_da