Improve Your MiFID II Efficiency by Using RegTech DataHub© – A New Data Framework

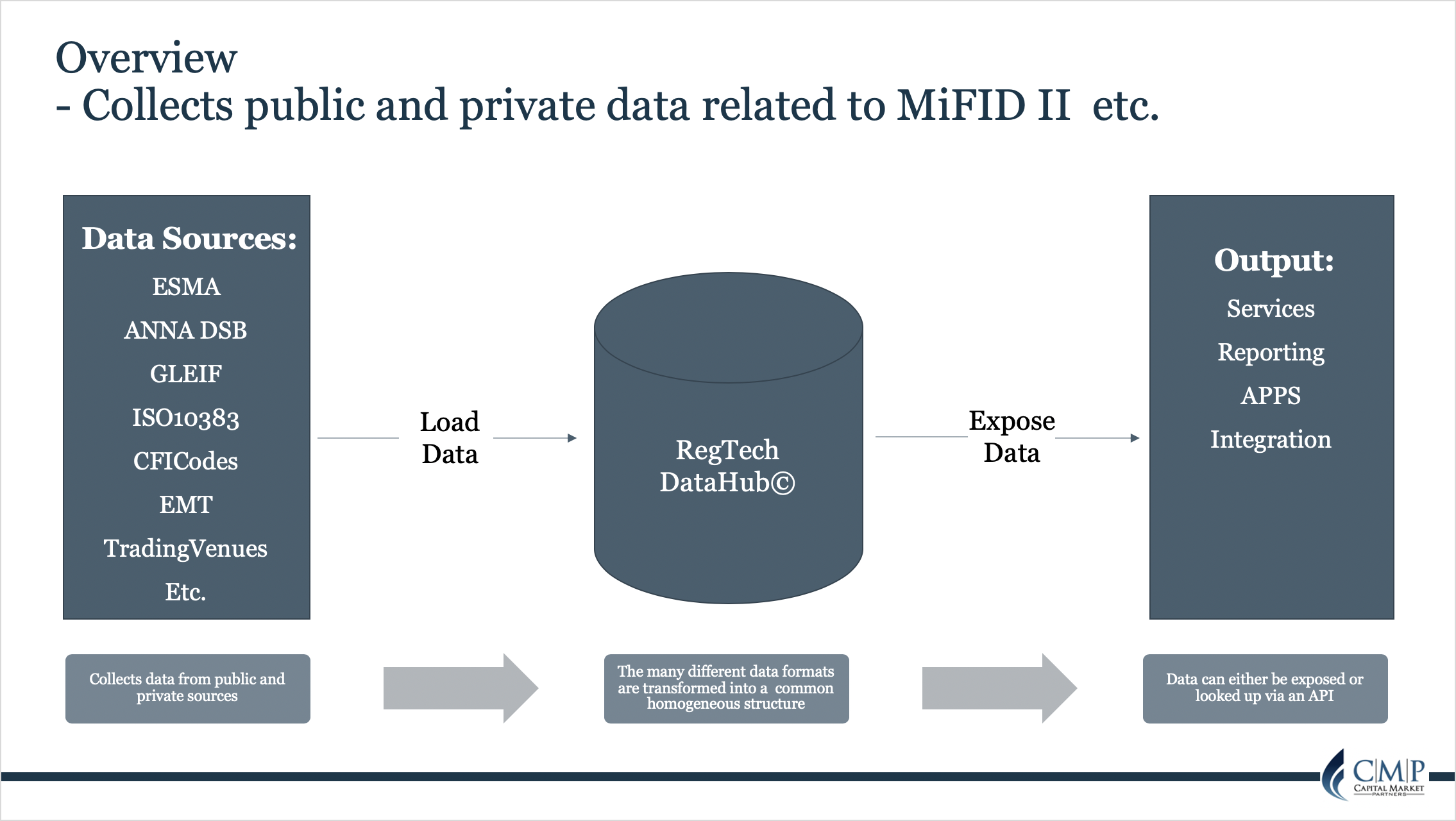

CMP has created a value-added solution called RegTech DataHub© that is a complete data framework collecting all MiFID II related data provided by Esma and other complementary sources. All the data is combined and structured in a way that leads to more efficient usage of MiFID II data and potentially huge cost savings.

By Jakob Werner Carlsen, Manager | The 16th of October 2019

The Idea Behind RegTech DataHub©

In the tail of the MiFID II regime, Capital Market Partners (CMP) observed that there was a need among our clients for a gathering of data output related to the MiFID II regulation. Some of the data is a result of reporting within the MiFID II framework and is published on different locations in different formats.

In general, the majority of the data sources are different and available through dissimilar formats.

The biggest challenge for the RegTech DataHub© project is to collect the data and put them into a data model where data is kept on a normalized form, while easily being combined with other entities within the whole framework. The data is stored in the same database, in order to ease the combination of data from the different sources and truly add value to the data.

The thought about the ESMA framework is quite simple and can be divided into two parts. One part which loads the data into the database and a second part, where the data is exposed internally in the organization. This would allow the organization only to rely on the internal data hub (data warehouse) and not worry about external data sources. No one in the organization should then worry about that the external data sources but only rely on the internal data hub.

What Can Financial Institutions Gain from This Information?

In RegTech DataHub© the huge amount of MiFID II data is structured in a more normalized way. It is not created with the purpose of some endpoint reporting or requirements but is created like a data source. From here data can be extracted, merged and combined in many ways. Having such implementation, the solution supports many different purposes of data usage for a given client.

RegTech DataHub© has several important benefits for the users, first of all data quality:

- Compliant – The data is primarily collected from ESMA, which ensures that clients are compliant with their reporting back to ESMA. Some of this reporting is based on the data published by ESMA.

- Another important benefit is the consistency of data usage. Using the same data source leads to more consistency in the usage of the data – if data is corrected in the main source, then every part that uses these data will be getting the newest data available.

- Some of the data is deducted or based on the data from ESMA, and the reporting, which is generated on ESMA, will then be more reliable.

Secondly, there are huge operational benefits;

- Ownership – An important outcome for financial institutions is the ownership of data. By using RegTech DataHub©, the institutions will own their data. In a world where data increasingly is a resource in itself, CMP see this as an opportunity for the clients to take ownership of their data.

- Cost savings – In terms of costs, RegTech DataHub© can moreover lead to cost reductions in the long run. The primary driver of this is the independence of expensive data providers.

- Furthermore, this can lead to the benefit that clients can make changes to own solutions. Hence, there will be no dependence on a data provider that potentially will not change in accordance with clients’ objectives.

With the current changing of the world and the increasing value of data, it is CMP’s view that future implementation of such solution as RegTech DataHub© is a good investment for clients being the master of the data they respectively use.

Included Data Sources

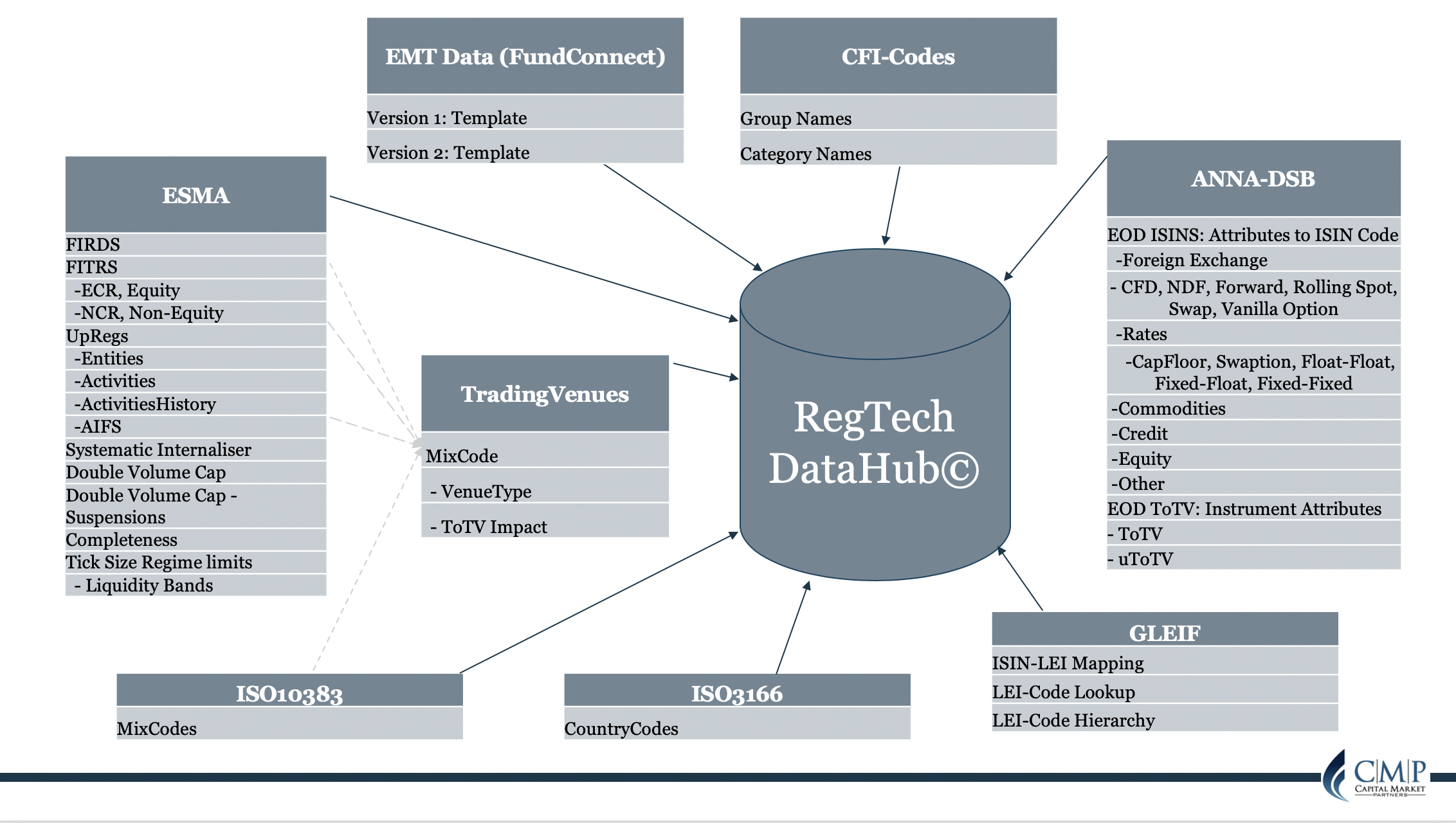

In the newly released version of RegTech DataHub© the underlying data warehouse has data from many various data sources. First of all, data from RegTech DataHub© has gathered data from ESMA two main registers FIRDS and FITRS that expose MiFID II data delivered to Esma by financial institutions. Secondly, RegTech DataHub© includes data from Anna-DSB, which is a global numbering agency for OTC derivatives. Anna-DSB provides their EOD ISIN files, which contains ISIN codes on derivatives, primary for FX and Rates.

The data from these sources are published on a daily basis. This allows CMP to implement different solutions in terms of load data to clients, depending on their specific needs.

In addition to the above-mentioned data sources, CMP has also included data from many other minor sources which is illustrated in the below chart.

The data sources are not finite and depends on the demand. Consequently, CMP will keep on extending the solution with new data sources when clients are requesting these.

RegTech DataHub© Is a Solution with Impact

Based on a deep understanding of all MiFID II related data from many different sources, RegTech DataHub© is a unique framework combining data knowledge with the domain knowledge of the entire business within a financial organization, which provides a very important prerequisite for having a solution with strong impact across the organization.

When combining the knowledge of data with the knowledge of business, it is possible to create solutions which have major impact across the organization. It is here that the real value is added to your data, when you can use the data correctly in the business framework. The requirements for the different usage and purposes of data whether it is raw, merged or enriched is the key for having a correct and value adding output.

The usage of the data/information which can be extracted from the data hub is important and should not be underestimated. The RegTech DataHub© solution is thought as a flexible solution where CMP has proposed some examples. The client can use these proposals or build their own on top of this. The content of the implemented solution should depend on the end requirements of the institution. The main thought is a universe with microservices, which are accessible within the organization.

If solution is made agile, new requirement demands from the business should be added into the current solution with small steps at a time.

Due to CMP’s experience with different organizations in the financial industry, CMP can help implement such solutions and here CMP can actually provide the base data for the solution. The final solution should be implemented in collaboration with the clients, so they understand how the final solution works.

Having experts across the whole value chain from front to back in financial institutions, one of the core competences of CMP is to actually implement solutions like the RegTech DataHub© at our clients. CMP helps all the way from collecting the requirements of the business to ensure that the requirements actually are implemented in the final solution.

There has been and still are extensions of the data hub, so CMP still extends the solution of gathering the data from various sources.

This is a proof of concept that with some effort you can build up powerful data source, which can be used for many different purposes.

How can CMP help your business?

If you have any questions about the RegTech DataHub©, please contact us.

Jakob has since 2002 gained experience in delivering complex core business systems within the financial sector. Besides financial skills, Jakob has a strong technical background that makes him capable of finding and implementing solutions to complex problems in IT systems. The combination of technical and business skills is reflected in his approach on issues handling and problem solving.

Read more about Jakob and our other consultants here

Login page for the RegTech DataHub©: www.regtechdatahub.com