It’s All About Dividend Tax: The Low-Cost Game in the ETF Market

This blog is not a pro and con of active versus passive investing. That topic is so well covered by academia and financial professionals. Rather, this blog aims at disclosing a not so often discussed feature in the ETF product: Securities lending programs and the dividend tax optimization as a mean for the low costs in the ETFs.

Jens Lohfert Jørgensen, Manager | April 4th, 2018

The ETF Market in Perspective

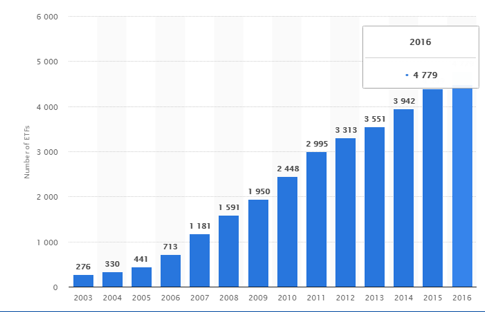

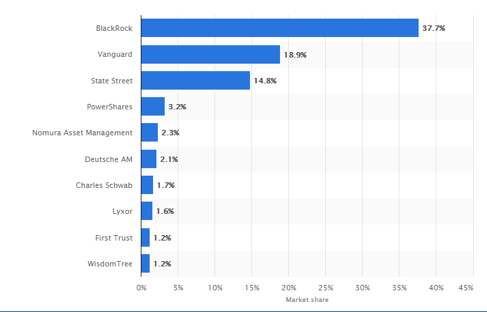

The Exchange Traded Funds (ETF) have during the last decade been among the fastest growing product groups in the Global financial markets. The total number of ETFs is approximately 5.000 with half of them listed in the US, and the other half listed on European exchanges. The largest provider of ETF products is by far Blackrock with its iShares family of ETFs.

In the US, ETFs and other index funds accounted in 2017 for close to 30% of the total assets under management, while in Europe the number was some 10%, and in Denmark even lower – according to the Danish FSA app. 5%.

In the US, the passive products are forecasted to surpass the actively managed assets sometime between 2021 and 2024.

So, easy to see, ETFs are a monumental blockbuster among investors. One reason often cited is the low cost: ETFs typically bear an all-in annual cost of 0.15-0.30%, while active mutual funds bear cost of 0.50-1.00% or even more.

Figure 1: Total number of ETF globally

Figure 2: ETF promotors by market share

(Source: Statista.com)

The ETF Dividend Tax Evasion

How come promoters (issuers of ETFs) are so eager to push the product? Because they profit far more than the admittedly low cost in the ETF indicate.

This is how it works:

ETFs are products which tempts to replicate the performance of an official index – primarily stock indexes like S&P500 or MSCI World. The performance of these indexes is calculated on a net tax basis. This means, that all dividends from the underlying stocks are added to the index value after subtracting 30% dividend withholding tax for US based stocks (other rates apply for companies based in other countries).

The average dividend yield paid by S&P 500 constituents is at the moment 2.0%. Hence, every year the index performance is positively influenced with a factor of 2.0% less 30% in withholding tax rate, i.e. 1.4%.

The remaining 0.6% is up for grabs.

If an ETF manages to reclaim all or parts of the withholding tax on its underlying stocks, then the reclaimed tax is an “icing on the cake” for the performance of the ETF.

In other words: It is quite possible for the ETF to match, or even outperform, the index that it is tracking. But most ETFs do not outperform, they just underperform with the low cost of 0.25%-points, and investors cheer! This leaves plenty of profit for the promotor of the ETF.

Securities Lending Operations

In practice, most ETFs handle the reclaiming of withholding taxes via securities lending operations. Those operations are organized by the major custodian banks. At the date of the dividend payment the custodian bank transfers the actual stock from the ETF to an off-shore company (the borrower), who then reclaims all or part of the withheld dividend tax from the tax authorities, and then immediately after transfers the stock back to the ETF.

Unofficial market intelligence states that app. 80% of all securities lending volume, is driven by withholding tax incentives. No market risk is involved for the ETF, as this is a lending transaction.

The profit from the transaction (in the example up to 0.60%) is split between the three parties involved:

The ETF, the custodian bank, and the company borrowing the stock during the dividend day.

On top of this, the investor pays the usual ETF administration fee of say 0.25%.

In total a fee of up to 0.85%-points just to match the performance of the index!

Is this a problem? No, only if the investors are not fully aware of what is happening or are having moral considerations on the issue of tax optimization. Some investors moving into the ETF market might have these considerations.

Jens Lohfert Jørgensen, Manager

Jens Lohfert Jørgensen, Manager

Jens Lohfert Jørgensen has been working in the financial sector since 1983. He has great experience and knowledge of investment and asset management, as well as a profound understanding of financial instruments, allocation, operations, trading processes, pricing, administration, cost structures, and the complexity of contract negotiations in asset management.

Jens has strong execution competencies and optimization experience of operational processes within investment functions.

Read more about Jens and our other consultants here.